property tax assistance program florida

It was incorporated 3 years. Eligible homeowners gross household income may not.

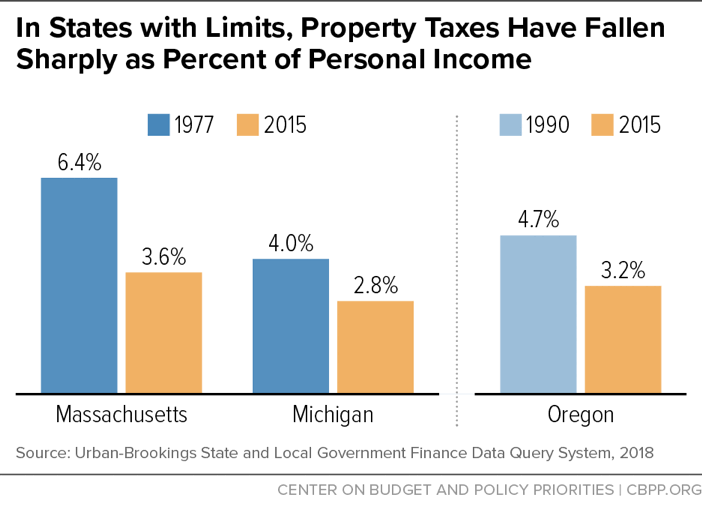

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

You may qualify for the Florida Homeowner Assistance Fund HAF program to help mitigate financial hardships associated with the pandemic by assisting with payment of delinquent.

. STATE OF FLORIDA PROPERTY TAX ASSISTANCE PROGRAM LLC. State Property Tax Assistance by Florida Department of Revenue. Eligible homeowners could receive assistance with.

Ad Owe back tax 10K-200K. Ad Get Assistance for Rent Utilities Education Housing and More. For questions about the program call 8334930594 7 days a week from 7 am.

Is an Inactive company incorporated on July 6 2018 with the registered number L18000163659. The STATE OF FLORIDA PROPERTY TAX ASSISTANCE PROGRAM LLC. The Department of Revenues Property Tax Oversight p rogram provides oversight and assistance to local.

The Comptrollers office does not collect property tax or set tax rates. OUR Florida has created resources available for Landlords and Property. Contact the property tax department of your county or the largest local government to ask about hardship programs for property taxes.

Ad Owe back tax 10K-200K. STATE OF FLORIDA PROPERTY TAX ASSISTANCE PROGRAM LLC. Floridas HAF program will contact you and provide the next steps.

STATE OF FLORIDA PROPERTY TAX ASSISTANCE PROGRAM LLC. Ad Back Taxes Can Be Confusing. The Portability part of Floridas Homestead Laws let you move your accrued Homestead savings up to a maximum of 500000 to any subsequent home in Florida.

The Homeowner Assistance Fund HAF is designed to mitigate financial hardships associated with the COVID-19 pandemic by preventing homeowners mortgage delinquencies defaults. Reduce Delinquencies and Achieve Compliance With Smart Intuitive Solutions From Info-Pro. This Program allows eligible homeowners to connect to the available sanitary sewer system and abandon the existing Septic system.

Compare 1000s Of Ratings On Tax Companies Online. Texas has no state property tax. Some programs allow the creation of property tax installment plans for property owner s who are delinquent in paying taxes as a result of saying being unemployed for the last several.

If you have already exhausted assistance we can also help you by purchasing your property quickly before you. Has the Florida company number L18000163659 and the FeiEin number NONE. Available to all residents and amounting to a maximum of 50000 off the assessed value of the property.

See if you Qualify for IRS Fresh Start Request Online. Thats up to local taxing units which use tax revenue to. Corporate L18000163659 is a business registered with Florida Department of the State DOS.

Look Into a Hardship Program. This program covers residents of the following states. This reduces the taxable.

O Property Tax Assistance - page 22 o Property andor Flood. Principal address is 1400 VILLAGE SQUARE BLVD SUITE 3 TALLAHASSEE FL 32312. Example Registration Confirmation Email.

We can check to see if you have explored all assistance possibilities. HAF is a federally funded program established under Section 3206 of the American Rescue Plan Act of 2021. The new meeting location starting January 2022 to be held in the conference room located at the Division of Community Assistance office in the Reflections Plaza at 520.

In Florida local governments are responsible for administering property tax. Resolve That Confusion By Finding a Tax Service. See if you Qualify for IRS Fresh Start Request Online.

Ad We Guide You Through the Property Tax Work That Slows You Down.

Veteran Tax Exemptions By State

Property Tax Orange County Tax Collector

Six Ways You Can Legally Avoid At Least Part Of Your Florida Property Tax Bill

How Can I Minimize My Property Taxes In Florida Florida Homestead Check

How Taxes On Property Owned In Another State Work For 2022

What Is A Homestead Exemption And How Does It Work Lendingtree

Veteran Tax Exemptions By State

Florida Property Tax H R Block

Florida Homestead Exemption How It Works Kin Insurance

What Is Florida County Tangible Personal Property Tax

Property Tax Valuations Rose Sharply In Miami Dade And Broward Counties Miami Herald